Industry Status, Development Trends and Competition

1. Industry status and development trends and competition

In 2020, with the ravage of the COVID-19 pandemic, the world has entered a "new normal" different from the past. This not only facilitated the relevant stay-at-home economy directly and zero-contact business opportunities but accelerated the application of many emerging technologies, making 2020 the year of growth for the global semiconductor industry.

According to the statistics of WSTS, the revenue in the global semiconductor industry reached US$440.4 billion in 2020, with an annual growth rate of 6.8%. With the popularization of vaccines and the gradual recovery of the economy, the revenue in the semiconductor market will continue to grow in 2021, with an estimated annual growth rate of over 10%.

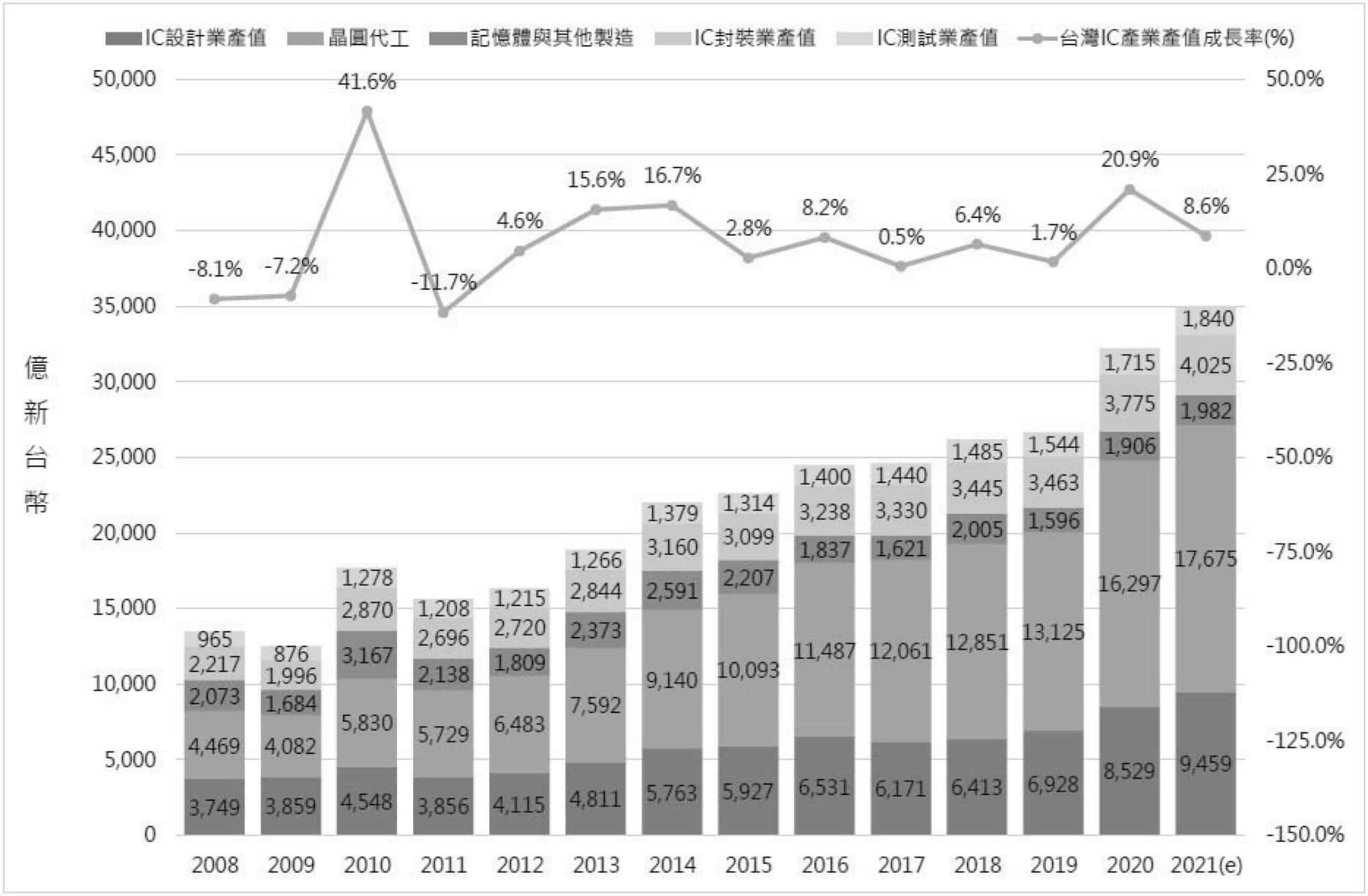

Benefiting from the proper control of the pandemic and due to the key role in the global supply chain, the output value of Taiwan’s semiconductor market in 2020 exceeded the NT$3 trillion mark for the first time, with an increase of 20.9%, which was far better than expected and the global growth rate. The output values of IC design, IC manufacturing, and IC packaging and testing in the upstream, midstream, and downstream sections of the industry were NT$852.9 billion (annual growth of 23.1%), NT$1820.3 billion (annual growth of 23.7%), and 549 billion (annual growth of 9.6%).

The output values of foundry in IC manufacturing were NT$1.629.7 billion (annual growth of 24.2%), and memory and other manufacturing categories were NT$190.6 billion (annual growth of 19.4%). Looking ahead to 2021, the demand for digital technology in the post-pandemic era will remain strong. The demand for smartphones and automotive electronics has rebounded. Coupled with the demand for higher capacity of 5G, AI, and high-performance computing applications, it is expected that Taiwan's semiconductor industry will continue to grow in.

2.Various development trends and competition of products

(1) Product development trends DRAM is an indispensable critical component in electronic products. Mobile phones, servers, and personal computers are the top three applications in the current market in terms of the demand, and the integration and development of AI, 5G network, and the Internet of Things (IoT) have driven more innovative applications. Driven by the demand for these end products, the development of DRAM in recent years has shown the trends below:

- Low power consumption In recent years, energy efficiency is a major requirement for the increasingly common wearable electronic products and relevant IoT applications, and therefore there are stricter requirements for the power consumption of DRAM.

- High speed With the stricter requirements for the speed of end products, the transmission specifications of DRAM are also evolving. It is expected that 2021 will be the first year of DDR5 memory.

- Miniaturisation To continuously enhance the competitiveness and cost effectiveness of products, the size of DRAM chips is bound to become smaller; as such, the output of chips from a single wafer will increase.

- Diverse applications With the emergence of more emerging applications, the application of DRAM will be more extensive. Either artificial intelligence of things (AIoT) or automotive or 5G applications, DRAM plays an crucial role.

(2) Competition: After many changes in the industry, the DRAM industry has entered an oligopolistic state. The top three players are Samsung, SK Hynix and Micron, collectively accounting for more than 90% of the market. In order to be differentiated from these three major players, the Company mainly produces and sells IC products and solutions, including specialty DRAM and known-good-die (KGD) memory, and serves as product service providers while stepping into the speciaty and application-driven buffer memory required for IoT-related products, such as cloud computing, automotive electronics, wireless communications, and wearable devices.

Technology and R&D Status

Within the Etron Group, the companies engaged in R&D are Etron Technology, Eever Technology, and Eys3d Microelectronics, Co. The technologies and R&D status are described as follows:

(1) Etron Technology, Inc.

Etron Technology The Company is a leading manufacturer of specialty buffer memory with consumer electronic products as the main market for a long time. We are committed to developing high-performance, low-power consumption specialty buffer memory products. The current full range of products include SDR, DDR, DDR2, DDR3, DDR3L, DDR4, and LP DDR2, with 4 to 64 bits of input and output, as well as a capacity covering 16Mb to 8Gb, among which 2x nano advanced manufacturing process is adopted for the mass production of the high-capacity products DDR2, DDR3, DDR3L, and DDR4. As for products, the Company not only can provide the commercial specifications for consumer market, the industrial specifications for strict use environments, or the automotive specifications with the highest quality and reliability depending on customer’s demands, but also can provide high-quality customized KGD (Known Good Die) solutions. The full series products were not only widely used by and in Netcom, set-top boxes, digital TVs, surveillance equipment, and other applications, but also used in the mass production and shipment of emerging applications such as 5G broadband communications, AI end points, and cloud storage, etc. in the supply chains of large-sized manufacturers. In addition, Etron Technology also proposed memory solutions for the design of the AI chips required for AI generation, i.e., the first RPC ® DRAM adopting WLCSP packaging technology in the world, which was a micro DRAM with the smallest form factor and can be used in high-frequency bandwidth, and which was more suitable for AI end points, such as wearable devices, the micro AI cameras on mobile devices, etc. In addition to satisfaction with the needs of end points, Etron accelerated the innovations with DWB (Direct Wide Bus) and RAL (Reduced Access and Latency) memory, and it is making in-depth research and development for future products to meet the challenges of the demands for 10GB/s or more to 400GB/s bandwidth for GDDR5 by adopting the methods different from HBM, so as to meet the increasing demands for computing and data throughput of AI SoC, and it provided controller + DRAM combined one-stopped solutions based on customer’s demands to initiate a new business mode.

(2) Eever Technology, Inc.

The company is mainly engaged in USB Type-C high-speed interface chip products, and its products cover integrated USB high-speed transmission interface, power supply, Type-C, audio-visual capture, and other technologies. It also introduced new underlying protocol for the latest USB 4 specifications, which supports existing USB3.2, USB2.0, Thunderbolt 3 and other compatibility to achieve the best interoperability of connected devices. The customers who formerly used Eever Technology, Inc.'s USB PD3.0 can expand their products to a variety of different applications, such as AC Adaptor, Power Bank, Car Charger, Video Dongle, in addition to allowing them to continue to launch products on/for PC, NB, Tablet, Docking and other applications, and thus improve their competitiveness. In addition, the company successfully developed new product lines for the IC products for USB audio and video capture for the live games on e-sports platforms recently, which can perform audio and video capture by taking advantage of USB control technologies, and which are adopted by important customers.

(3) Eys3d Microelectronics, Co.

The company is mainly engaged in 3D imaging chip products and adopts ultra-wide vision imaging technology and depth-of-field point cloud depth algorithm to integrate and develop machine-vision sensing modules as well as monocular, binocular, and multi-eye 3D ThingCaptureTM Vision cameras, and combined exclusive SDK development kit for making machine learning models to be applied in image recognition, 3D gesture recognition, and 3D hologram (hologram projection). With improved image pixels, update rate, large viewing angles, and refined depth map processing algorithms of the depth map processing units, the company's derived product lines have ranked among the world's leading technology groups, and it has become a designated partner of international companies in AR /VR HMD, Thing Capture, Robot, and Logistic. All of the above can become the tools for AI Edge End Point computing as well as depth learning and development.

Short / Long-term Development Plan

1.Short-term business development plan

- Accelerate global business expansion and continue to increase the business growth from strategic clients and regional clients.

- Introduce new specialty memory, increase the sales of KGD and industrial and automotive application memory, thereby expanding the market and strengthening the stability of the long-term market layout and profitability.

- Develop a global layout together with clients and grasp new business opportunities arising from the reorganization of global supply chains.

- Keep abreast of the USB Type-C interface standard trends and accelerate the expansion of the Type-C product line and the revenue and client base of audio and video capture systems.

- Committed to occupying the emerging 3D depth image application market by means of the outstanding R&D achievements in 3D depth imaging technology.

2.Long-term development plan

- Continue to take advanced process technology as the core of development, and provide global clients with specialty, stacked, customized, and application-driven memory products and services through the most competitive advantages in the market.

- Break through and innovate the business model of non-standard memory products to accelerate the market penetration.

- Undertake multi-faceted product integration to expand services to international, strategically important clients.

- R&D new memory technologies required for the advent of the AI generation, and innovate the business models for the cooperative application of IP achievements.